Take a single payment

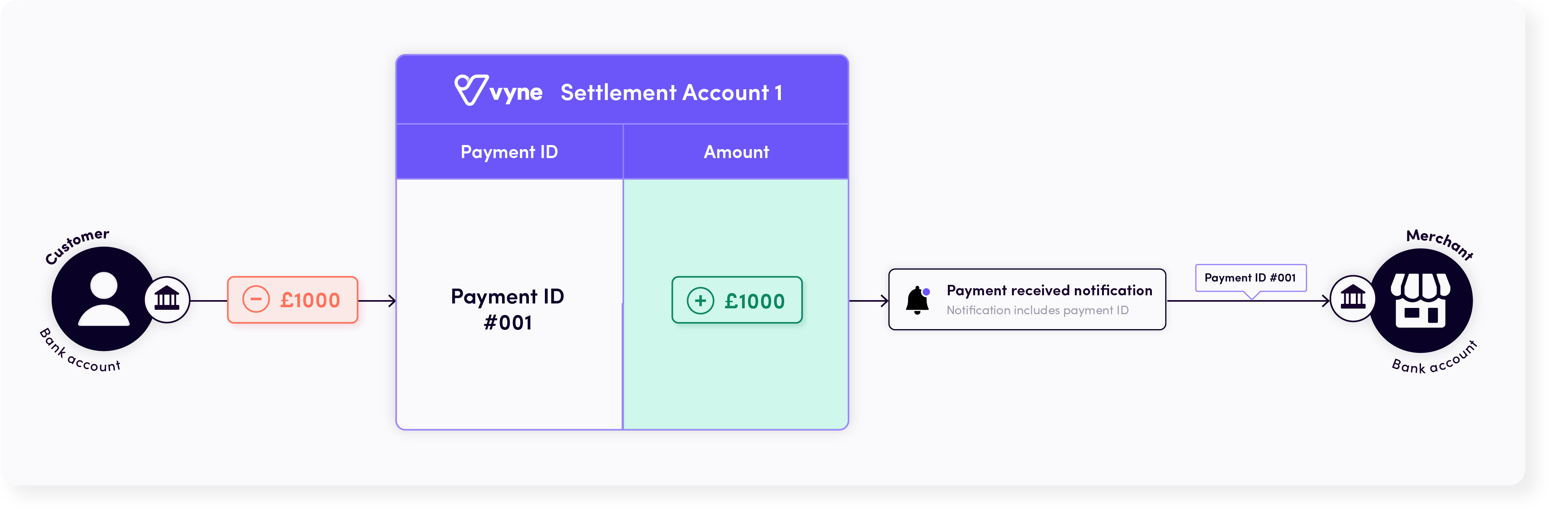

Take single instant, domestic bank-to-bank payment. Consumers can pay using a bank transfer from their account directly to your merchant account.

Consumers are presented with a payment summary and can authorise payment with a single step.

Integration pattern

- The merchant begins the payment initiation by creating a PIR. Vyne interfaces with Open Banking to create a payment with the requested amount and payee details.

- Once the PIR is created, the payment needs to be presented to the consumer in order to allow them to select a bank. A redirect URL or QR code URL returned when creating the PIR provides a way to redirect the consumer to a Vyne hosted checkout page.

- The consumer selects their bank and consents in the hosted checkout.

- After consenting, the consumer is redirected to mobile banking (mobile bank app) or online banking (website). The consumer authenticates with the bank biometrically or using credentials.

- At the bank, the consumer is prompted to authorise the payment.

- Once the payment is authorised at the bank, the consumer will be redirected back to the callback URL provided in the PIR.

Before you begin

Before you begin your integration, make sure you've run through our getting started guide to sign up for an account, get an access token, and configure a callback URL.

Updated over 2 years ago